The television entertainment industry in South Africa is in for significant disruption in the next 18 months. And couch potatoes look set to be the biggest beneficiaries as competition intensifies between traditional broadcasters and new Internet streaming providers.

The television entertainment industry in South Africa is in for significant disruption in the next 18 months. And couch potatoes look set to be the biggest beneficiaries as competition intensifies between traditional broadcasters and new Internet streaming providers.

The trigger for much of the change looks set to be Netflix, which confirmed earlier this year that South Africa will be one of the markets into which it will launch its Internet video-on-demand (VOD) services by the end of next year. The announcement was always going to ruffle feathers, especially at MultiChoice, which dominates the pay-TV market.

Indeed, Netflix’s declaration that it intends growing the number of countries in which it operates from 50 to 200, including South Africa, by December 2016 appears to have triggered a pre-emptive strike by Naspers.

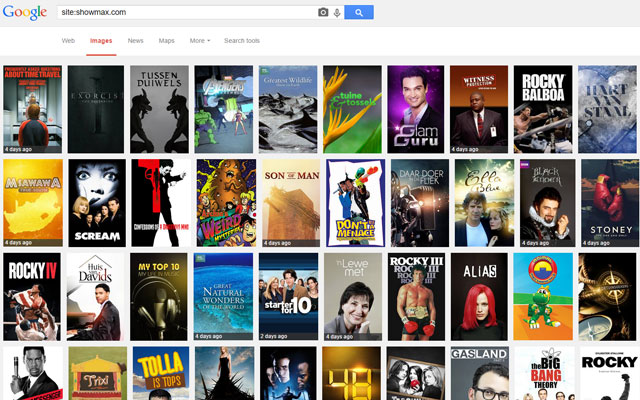

The media group, which owns DStv, is set to launch a video-on-demand service this week called ShowMax. The former CEO of DStv Digital Media, John Kotsaftis — who led the launch of the Catch Up and BoxOffice products — will head up ShowMax. The new business is apparently separate to MultiChoice, perhaps signalling that Naspers is keen to foster rivalry in the group to accelerate innovation.

MultiChoice and Naspers have never taken competitive threats lying down. They were never not going to defend their ground against Netflix and other streaming providers.

More details about Naspers’s streaming TV plans will emerge on Wednesday when the group holds a press conference.

But Netflix isn’t the only rival threatening to chip away at DStv’s dominance in pay TV. Times Media Group was early to market with a streaming offering called Vidi, although it’s not clear how well it’s done. There has also already been one spectacular failure: the satellite VOD-based Altech Node, which parent Altron is now looking to offload.

Perhaps more interesting to watch will be South Africa’s big telecommunications operators, which are coming to regard VOD as a value-add for their broadband users.

MTN has already launched FrontRow, though it has hasn’t disclosed subscriber numbers. Vodacom is biding its time, but the operator is known to be testing subscription VOD offerings, which it intends providing to its fibre-to-the-home customers. Telkom has been slow in bringing an offering to market, but is also understood to be working on a solution.

As speedier broadband comes to the suburbs thanks to new fibre players and investments by Telkom in both fibre and faster copper technologies, streaming is becoming a viable alternative to DStv, especially for those who don’t want or need access to the SuperSport channels.

But it’s not only in streaming where South Africa’s TV industry is set to get more lively. It’s likely that the commercial switch-on of digital terrestrial TV will happen in the coming months. The SABC, e.tv and M-Net will all launch new terrestrial channels, and new players in free-to-air and subscription services are likely to come to market.

Then there’s On Digital Media (ODM), the parent of StarSat (formerly TopTV), which is getting near to coming out of business rescue, which it’s been in for the past three years. It’s waiting for the transfer of its licence by its regulator before finalising the rescue process. New investor, China’s StarTimes, is expected to help StarSat launch new products and services as it seeks to claw market share away from MultiChoice.

“I would expect that the relationship with StarTimes is going to bring in new innovations,” ODM’s Eddie Mbalo told me this week. Mbalo, a former ODM CEO, has been appointed as a director of the company’s newly restructured board.

Already, MultiChoice and StarTimes are fierce competitors across Africa, especially in subscription digital terrestrial television, so there’s every reason to expect the two to have a proper barney in South Africa, too.

Indeed, Mbalo signalled that ODM is ready for a fight when he said that the broadcaster has no intention of abandoning its 2013 complaint against MultiChoice at the Competition Commission over sports rights.

The battle for viewers is about to get very interesting indeed. Don’t dare change channels.

- Duncan McLeod is TechCentral’s editor. Find him on Twitter

- This column is also published in the Sunday Times