The price of DStv’s most popular bouquets will rise by between 8% and 10% on 1 April 2016, with parent MultiChoice blaming the sharp devaluation in the value of the rand over the past 12 months for the above-inflation increases.

TechCentral can reveal that DStv Premium, parent MultiChoice’s top-end bouquet, will rise in price from R699 to R759/month on 1 April, an increase of 8,6%.

Premium subscribers with a personal video recorder (PVR) decoder must also pay an R85 access fee (up from R80 now), taking the total cost to R844/month. The fee gives subscribers access to an additional viewing environment in their homes as well as access to services such as DStv Catch Up, BoxOffice and DStv Now.

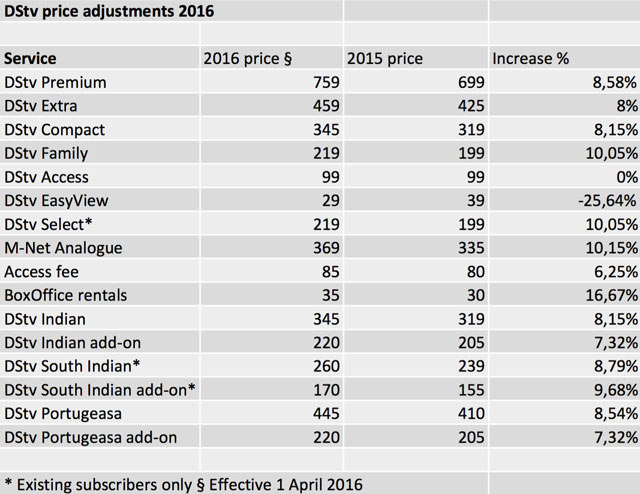

DStv Compact customers will see their subscription fees climb by 8,2%, while those on DStv Extra and DStv Family will have to fork out 8% and 10% more respectively from next month (see the table below for the full price adjustments).

Those on MultiChoice’s most basic bouquet, DStv EasyView, will see their subscriptions reduced from R39 to R29/month, a decline of more than 25%. The price of DStv Access, meanwhile, will remain unchanged at R99/month.

The few remaining subscribers on the M-Net terrestrial service will have to fork out more than 10% extra each month, with the fee rising to R369.

Decoder insurance fees remain unchanged.

In a letter being issued to customers today announcing the price increases, MultiChoice said: “We buy most of [our] fantastic content in foreign currency, and due to the depreciation of the rand by 29% since April 2015, our costs have gone up dramatically. Over the past five years, our adjustments have been in line with inflation. We’ve worked really hard to keep this year’s fees manageable.”

In an interview with TechCentral on Tuesday, MultiChoice South Africa chief operating officer Mark Rayner said that the company has been working hard to ensure price increases are kept in check as much as possible.

This has included not renewing certain sports rights, such as the Bundesliga.

“We are having to work very closely with content providers and channel partners to be canny with our spend and be more selective in some regards,” Rayner said. “We obviously want to ensure we still get the best programming we can, but it’s a case of being a little bit smarter.”

He said the company, which is owned by technology and media giant Naspers, has scrutinised all of its operational expenditure and worked closely with suppliers to keep cost increases to a minimum.

“We’ve taken great pain to keep the price increase at a reasonable level,” he said. “It’s interesting to see what Eskom and the medical aids are doing. We want to keep the impact on customers to as little as possible.” — (c) 2016 NewsCentral Media